The Sleep Loft products are now HSA/FSA eligible through Medpaid.

Using pre-tax funds through Medpaid can help you save up to 40% on your The Sleep Loft purchases—while investing in deeper, better sleep.

How it works

Pay with HSA/FSA in 3 quick steps

Choose HSA/FSA at checkout, complete a quick health assessment, and pay with your HSA/FSA card to unlock savings.

Choose “Pay with HSA/FSA during checkout” to start the eligibility flow.

Answer a few quick questions so a provider can determine eligibility (often supported by an LMN).

Once approved, pay with your HSA/FSA card to capture pre-tax savings—up to 40% depending on your tax rate.

Savings breakdown

How do pre-tax HSA/FSA dollars save you 30 - 40%?

When an item qualifies via a LMN, you can use HSA/FSA funds so your out-of-pocket cost can drop compared to paying after-tax.

Note: Savings vary by individual tax circumstances and plan rules. Keep documentation for your records.

Shop HSA/FSA Eligible & Save Instantly

The Sleep Loft offers dozens of HSA/FSA-eligible products from top brands such as LEESA, Helix, and more.

-

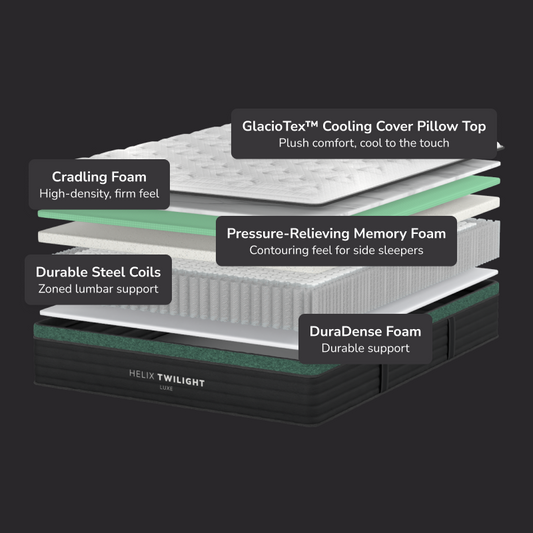

2025 Helix Twilight Luxe - Includes GlacioTex™ Cooling Cover

Vendor:HelixRegular price From $1,264.00Regular priceUnit price per$1,622.80Sale price From $1,264.00Save -

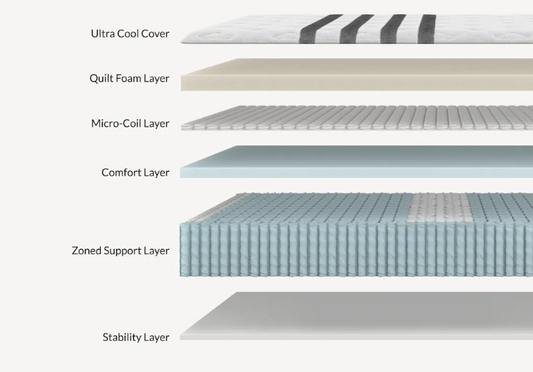

Leesa Legend Chill Hybrid Mattress

Vendor:LeesaRegular price From $1,679.00Regular priceUnit price per -

2025 Helix Midnight Luxe - Includes GlacioTex™ Cooling Cover

Vendor:HelixRegular price From $1,264.00Regular priceUnit price per$1,622.80Sale price From $1,264.00Save -

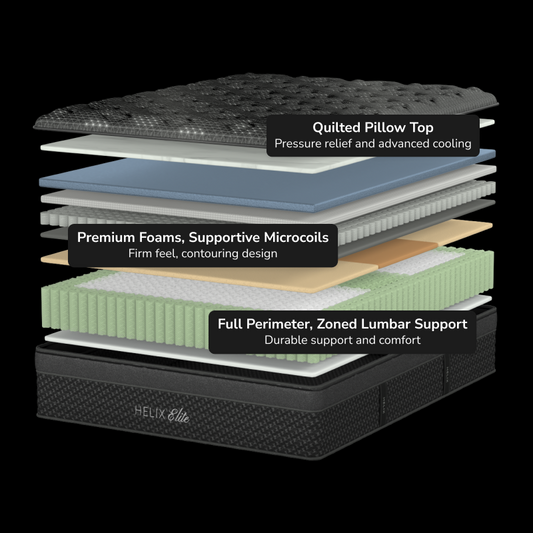

2025 Helix Midnight Elite

Vendor:HelixRegular price From $1,874.00Regular priceUnit price per -

Leesa Sapira Chill Hybrid Mattress

Vendor:LeesaRegular price From $1,359.00Regular priceUnit price per

Why use pre-tax funds?

Turn sleep essentials into tax-advantaged health investments.

Your favorite The Sleep Loft mattresses, pillows, and accessories may qualify as HSA/FSA-eligible when supported by a FREE Letter of Medical Necessity (LMN) issued through Medpaid.

Eligible purchases can be reimbursed from your HSA/FSA account, letting you use income that hasn’t been taxed.

Many FSA plans are “use it or lose it.” Turning those dollars into better sleep captures value you’d otherwise forfeit.

When your The Sleep Loft purchase qualifies with an LMN, you can use pre-tax HSA/FSA dollars on products that support alignment, comfort, and restorative rest—so you’re investing in better sleep and smart tax savings at the same time.

FAQ

Common HSA/FSA Questions

Reimbursement: Pay with any card, complete the assessment to obtain an LMN, then submit your receipt and LMN to your HSA/FSA administrator for repayment.

Step-by-step help: How to reimburse with HSA/FSA.